Become A Founding Member of the "Fire Your Landlord Club!"

IF YOU'VE WANTED TO BUY A HOME

FOR YEARS AND YOU'VE NOT BEEN ABLE TO

IMPROVE YOUR CREDIT SCORES, THEN

CHANCES ARE YOU DON'T KNOW

HOW CREDIT SCORES WORK.

IF YOU'VE WANTED TO

BUY A HOME FOR YEARS AND YOU'VE NOT BEEN ABLE TO IMPROVE YOUR CREDIT SCORES, CHANCES ARE...

YOU DON'T KNOW HOW

CREDIT SCORES WORK.

Most people think credit scores are a mystery, leaving them stuck renting and unable to achieve

their homeownership dreams.

In Fire YOUR LANDLORD, I will walk you through the exact process that can unlock your

potential for homeownership.

By understanding how credit really works—and more importantly, how to fix it—

you can build the credit needed to qualify for a mortgage.

Forget the confusing advice and discover a system that will finally bring results.

For years, it felt like anyone could get a mortgage if they just worked on their credit for a few months.

But now, more people are stuck in a cycle of bad credit and high rent, making homeownership seem impossible.

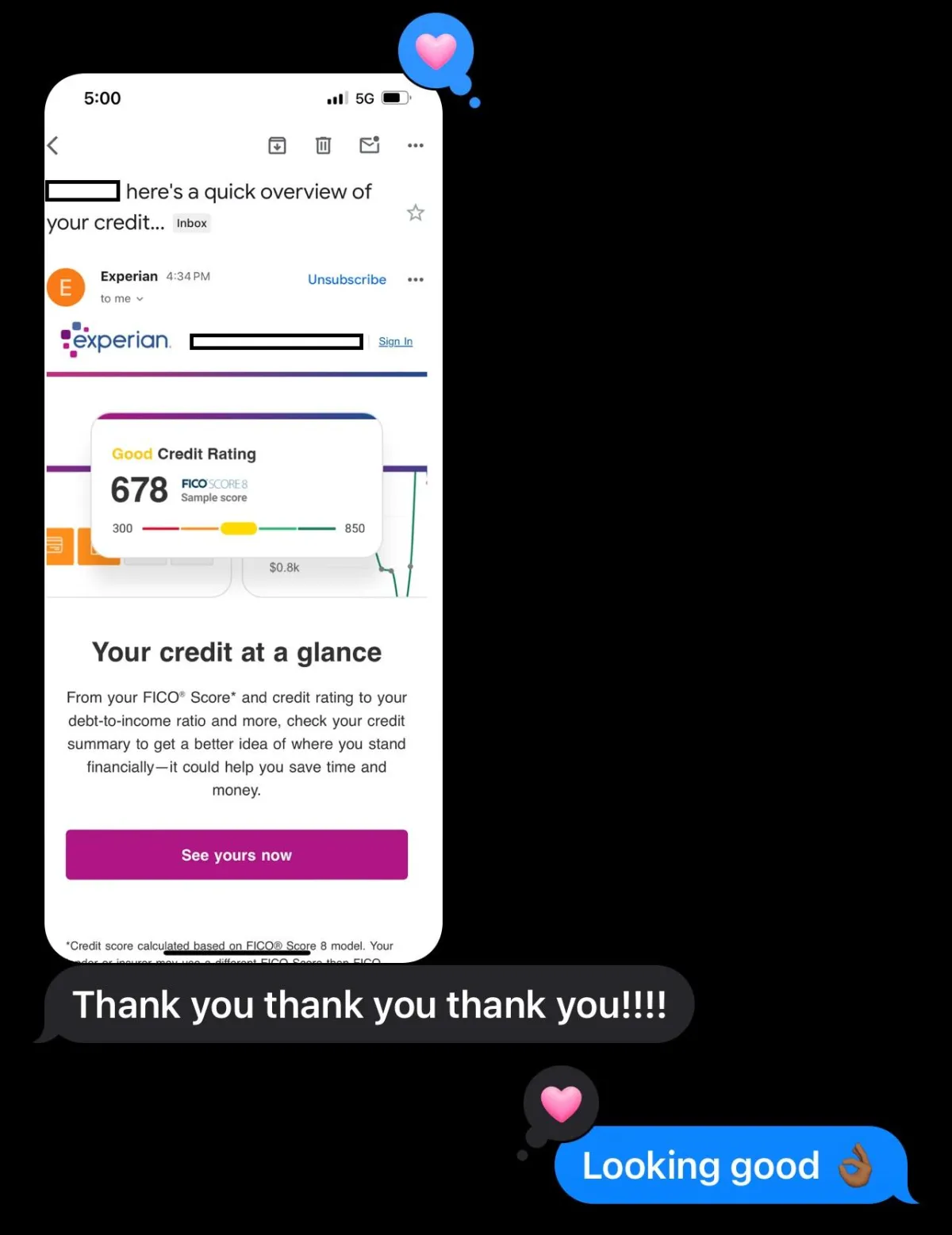

While others are still struggling to get approved for a mortgage, I have clients moving into homes

faster than they ever thought possible—thanks to the strategies I’ve developed.

You’ll learn how to work on your credit efficiently and with intention, so you’ll attract lenders who are ready to say "yes."

Building a high credit score isn’t about having a lot of credit—it’s about using the right kind of credit wisely.

In this program, I’ll show you how to rebuild your score and get on the fast track to homeownership.

Most people think credit scores are a mystery, leaving them stuck renting and unable to achieve their homeownership dreams.

In FIRE YOUR LANDLORD, I will walk you through the exact process that can unlock your potential for homeownership.

By understanding how credit really works—and more importantly, how to fix it—

you can build the credit needed to

qualify for a mortgage.

Forget the confusing advice and discover a system that will finally bring results.

For years, it felt like anyone could get a mortgage if they just worked on their credit for a few months.

But now, more people are stuck in a cycle

of bad credit and high rent, making homeownership seem impossible.

While others are still struggling to get approved for a mortgage, I have clients moving into homes faster than they ever thought possible—thanks to the strategies I’ve developed.

You’ll learn how to work on your credit efficiently and with intention, so you’ll attract lenders who are ready to say "yes."

Building a high credit score isn’t about

having a lot of credit—it’s about using the right kind of credit wisely.

In this program, I’ll show you how to

rebuild your score and get on the

fast track to homeownership.

If you're ready to learn how to increase your credit scores AND meet the four requirements for your mortgage, I'll show you:

The most effective way to repair your credit and boost your scores fast (this approach is proven and actionable)

The exact steps to optimize your Debt-to-Income ratio so lenders are ready to approve you

How to prepare your work history and down payment to meet mortgage guidelines quickly

How to position yourself as a qualified buyer so lenders want to work with you and give you the best rates

BONUS: Get access to exclusive strategies like the 4-2-9 Rule to build and maintain great credit for life!

💫You know that your credit score is holding you back from buying a home. You’ve been trying to improve it, but nothing seems to be working.

🚫You feel stuck renting, not knowing how to meet the credit requirements for a mortgage. It's time to take control of your credit and start seeing real progress that will lead to pre-approval...

💫You know that your credit score is holding you back from buying a home. You’ve been trying to improve it, but nothing seems to be working.

🚫You feel stuck renting, not knowing how to meet the credit requirements for a mortgage. It's time to take control of your credit and start seeing real progress that will lead to pre-approval...

That's where "Fire Your Landlord" comes in—to finally show you how to take control of your credit and meet the FOUR mortgage requirements. It’s time to build a strong credit profile that gets you closer to homeownership, not just spinning your wheels. You'll learn exactly what it takes to get approved, so you can STOP DREAMING AND START OWNING.

If you've been trying to improve your credit for years without results, it's because you're not using the right approach.

Fire Your Landlord will show you how to build the right credit strategy that lenders are looking for.

You'll get real, actionable steps to get pre-approved for your mortgage and finally own a home.

No one is teaching credit like I am.

Fire Your Landlord is the #1 program you need if you're serious about changing your credit game and becoming a homeowner.

Value: $1,999+

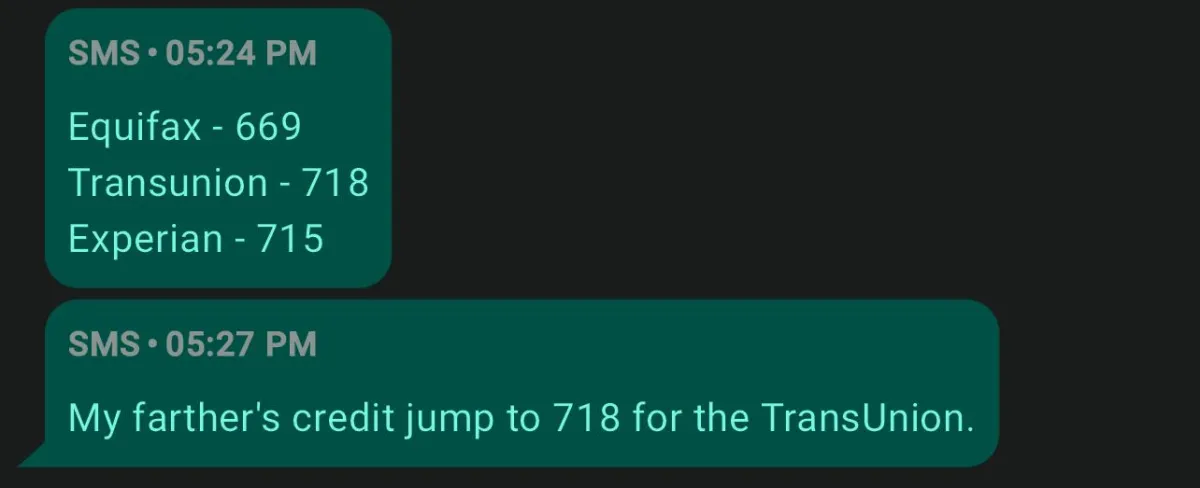

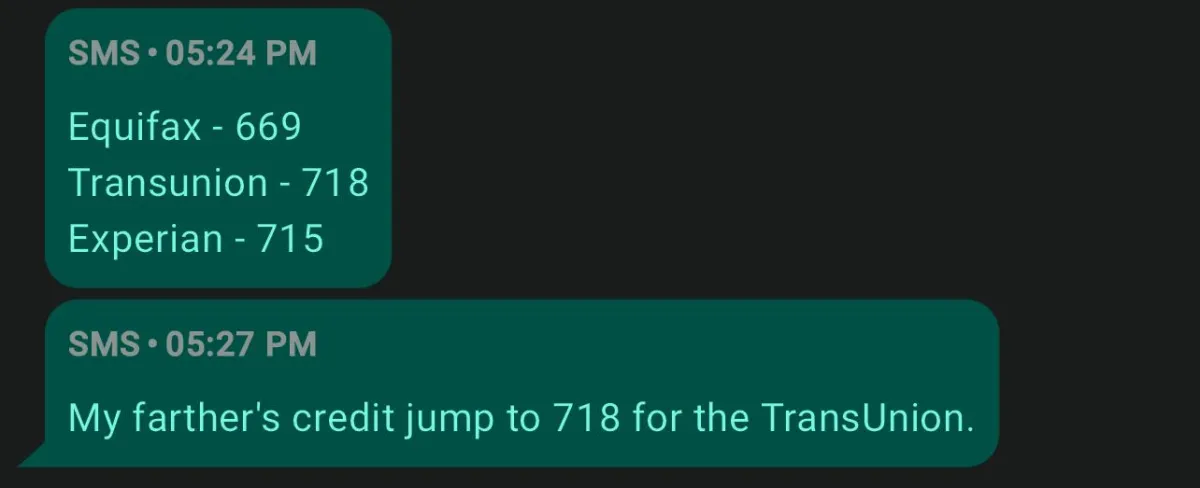

Access all three of your credit reports (Equifax, Experian, TransUnion)

Learn how to read and interpret your credit reports like a pro

Master the 5 categories that determine your credit score

Get access to new trade lines to boost your score

Use the Debt-to-Income Ratio Calculator for accurate loan planning

Remove late payments with a single phone call strategy

Negotiate collection debt strategy

Choose the best loan package tailored to your needs

Bonuses:

Bonus 1: Homebuyer Checklist: Step-by-step guide to prepare for the mortgage process.

Bonus 2: Managing Credit Cards for Homeownership Guide: Learn how to strategically manage your credit cards for better approval chances.

Bonus 3: Secured & Unsecured Credit Cards List: A secret list of credit cards to help you build or rebuild credit.

Bonus 4: Cash Flow Calibration System (Course Access): A budgeting system to improve your cash flow and save for a down payment.

Bonus 5: Affordable Payments (Course Access): Learn how to calculate your budget and determine your home affordability.

All of This FOr Only $997 $197!

(Save $800!)

Trailblazer Special: $97!

Become a founding member of the "Fire Your Landlord" Club and take advantage of this early adopter special!

Ready to Take Control and Start Owning?

Join Fire Your Landlord today, and unlock the proven strategies to boost your credit, meet mortgage requirements, and finally get pre-approved for your dream home.

Don’t wait—your journey to homeownership starts now.

Complete The Form Below To Secure Your Spot!